What are NCDs?

NCDs stands for Non-Convertible Debentures. It is a fixed-income investment issued by companies to raise funds from the public, financial institutions and high-net-worth individuals at a fixed interest rate for a pre-agreed period (or Tenor). NCDs are non convertible meaning that they cannot be converted into equity shares of the company and hence offer a fixed return.

How does NCD work?

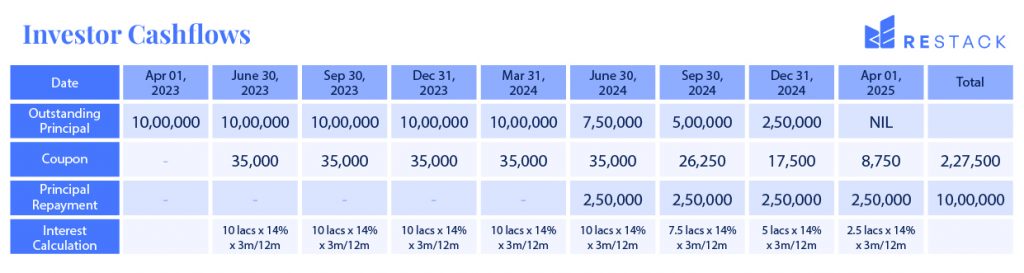

The company which issues NCDs (called Issuer) makes the interest payments (also called Coupons) to NCD holders on a monthly, quarterly, semi-annual or annual basis over the Tenor. Let us understand this with the help of below example:

ABC private limited has raised funds of INR 10 Crores through Non-Convertible Debentures (NCDs) with a face value (FV) of INR 1,00,000 for a period of 2 years starting from Apr 01,2023 with a fixed interest rate of 14% p.a. payable quarterly. As per the pre-agreed terms the company will repay the principal in 4 equal quarters starting from the second year. Here are the broad terms of the NCDs used,

- Issuer – ABC private limited

- Tenor – 2 years i.e. Apr 01, 2023 to Mar 31, 2025

- Coupon – 14% p.a.

- Coupon pay-out frequency – Quarterly

- Principal Moratorium – Only coupon is paid during this period i.e. since principal is

repaid from the second year, there is a Principal Moratorium in first year. - Repayment (or Amortisation) – It is the period in which principal invested is paid back.

Let us assume that you have invested INR 10 lacs in NCDs of ABC pvt Ltd. Your interest or Principal repayment is shown below,

The investment multiple is ~1.23x i.e. 12.27 lacs comprising of Coupon of 2.27 lacs and principal repaid 10 lacs on your invested Principal of 10 lacs.

Further, NCDs can be broadly classified into secured and unsecured NCDs.

Why Secured NCDs?

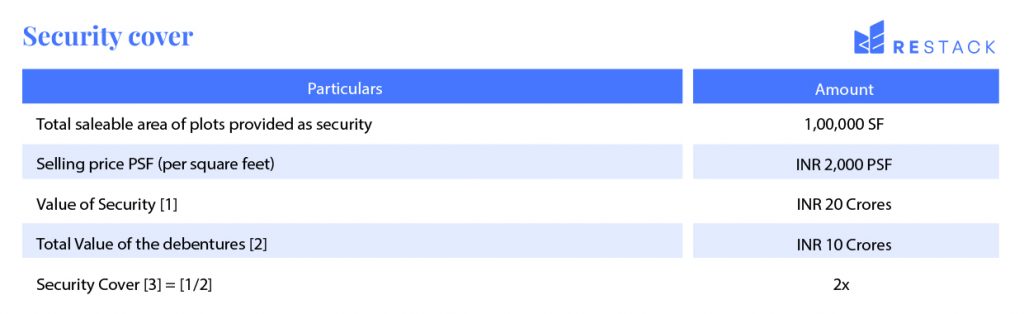

Secured NCDs are secured by assets owned by the company, which can be sold to recover the investment in case the company defaults. All the NCDs listed on The Restack platform are secured by real estate assets in the form of land, plots or apartments with a significant security cover upwards of 1.5x.

Let us continue with the above example wherein the company had issued NCDs of INR 10 Crores. Further, the company has provided security in the form of residential plots. The security cover calculations are as below,

In simple terms if an investor has invested INR 10 lacs, then the security for his investment amount would be INR 20 lacs. Thus, the Security of INR 20 lacs has a significant buffer built in over and above the Principal and coupon to cover your investment of any risks or unforeseeable market events associated with these NCDs.

Why NCDs on The Restack platform?

The Restack an online real estate investment platform showcases opportunities across the real estate capital stack including Commercial Real Estate (CRE) & High Yield Debentures (NCD). These NCDs can be invested on our platform through a simple and digital online process and have the following advantages.

Investing in NCDs carries certain risks. The biggest risk is the possibility of default by the company, which can lead to a loss of capital and interest income. Hence, each NCD investment on the platform is backed by real estate security with significant security cover.