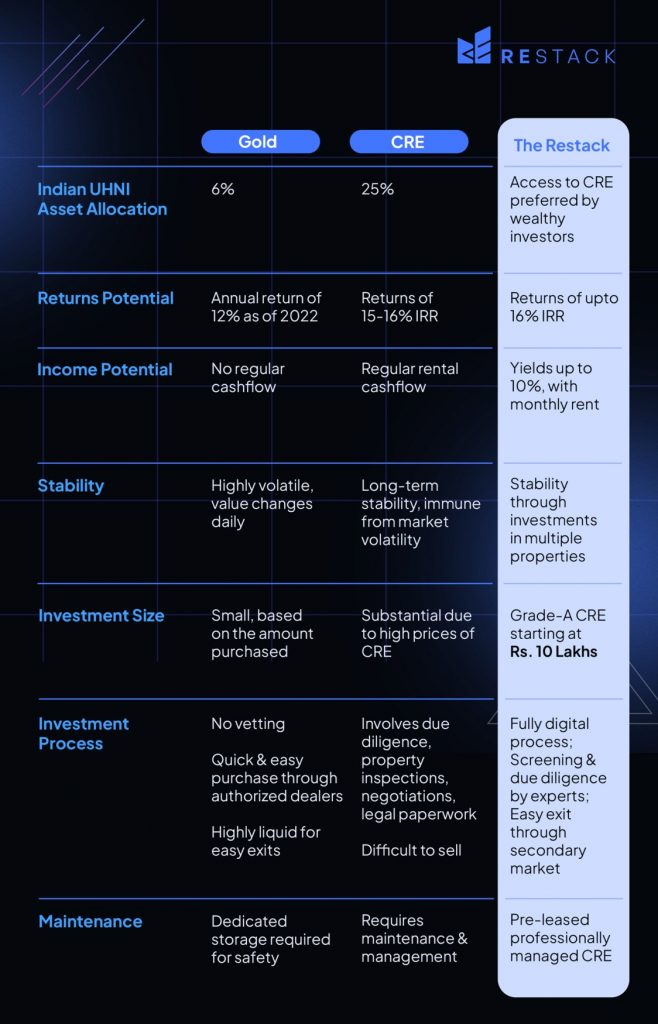

When investing your hard-earned money, asset allocation, diversification, and rebalancing are critical decisions to manage risk and reward. Among the many investment options available to modern investors, commercial real estate (CRE) and gold are highly preferred asset classes, with both assets having outpaced equity in FY2023. Indian UHWNIs show a strong preference for commercial property, with CRE making up 25% of their asset allocation.

The Restack offers fractional real estate investments to simplify access to high-value CREs, retaining the benefits of CRE while mitigating the risks associated with traditional real estate investment. In this article, we will delve into the key differences between the two asset classes and examine the advantages and disadvantages of each.

Income Potential

Gold is primarily a wealth preservation asset and does not generate any income. The profit from investing in gold comes from capital appreciation, i.e., selling the gold at a higher price than the purchase price. Conversely, CRE provides a regular income stream through rents, plus substantial capital appreciation. The rental income provides steady cashflow while you still retain ownership of the asset.

Verdict: CRE – 1 | Gold – 0

Returns Potential

Historically, both gold and real estate have demonstrated growth potential. However, while gold prices increase over the long term, the asset is characterized by intense short-term price fluctuations. Real estate, on the other hand, typically experiences steady price growth, offering an economic boost as your mortgage shrinks and your equity rises. In 2022, gold yielded an annual return of 12%. Compared to this, commercial real estate offers an average 15-20% IRR.

Verdict: CRE – 1 | Gold – 0

Long-Term Stability

Gold prices can be quite volatile as they are subject to constant fluctuations in the global market. In contrast, real estate prices are less volatile and are not dictated substantially by market sentiments or economic ups and downs. Except for during major financial crisis, real estate prices show steady, predictable growth over the long term.

Verdict: CRE – 1 | Gold – 0

Investment Size

Gold investment can start from just a thousand rupees, making it accessible to many investors. In contrast, commercial properties require a larger initial investment, which includes the purchase price, closing costs, potential renovation expenses, and ongoing maintenance costs.

Verdict: CRE – 0 | Gold – 1

Investment Process

Buying gold is a relatively straightforward process, with transactions often completed within hours. Vetting for gold purity and seller authenticity is important, but you can bypass this by buying directly from reputable dealers. Moreover, gold is a highly liquid asset and can be quickly converted into cash when needed. Investing in real estate is a more complex process and can take weeks or months to complete. It involves property inspections, appraisals, property selection, negotiation, financing, and legal paperwork. Professional services such as real estate agents and lawyers are needed to ensure a smooth transaction. Plus, selling a property often takes months.

Verdict: CRE – 0 | Gold – 1

Maintenance

Gold requires minimal maintenance. The primary concern is secure storage and insurance, which may add to the costs and impact overall ROI. Real estate, on the other hand, requires ongoing maintenance and potential renovations, which requires effort, time, and money. If you’re renting out the property, you’ll also have to manage tenant relations and potential vacancies.

Verdict: CRE – 0 | Gold – 1

Embracing the Best of Both Worlds: Fractional Real Estate Investment with The Restack

A new concept that has entered the investment arena is Fractional Real Estate Investment – set to revolutionize the world of property investment by combining the benefits of different asset classes while mitigating the disadvantages associated with them.

- Investment Size: Fractional real estate investment does not require a substantial capital outlay. The Restack’s marketplace offers you access to institutional-grade real estate with fractional ownership and NCDs starting at only Rs. 10 Lakhs.

- Investment Process: Every property listed for fractional investment undergoes a strict vetting process, ensuring that only high-quality properties make it to the platform. At The Restack, proposals are filtered for the ones fitting our investment thesis and clearing our initial screening checklist. On clearing the screening process, detailed evaluation is done on market, asset, title, and technical aspects. The Restack also has a dedicated secondary marketplace that enables easy exits.

- Maintenance: In the fractional model, property maintenance is not the investor’s headache. The Restack owns the responsibility of property maintenance, lease management, property tax, insurance, & SPV compliances.

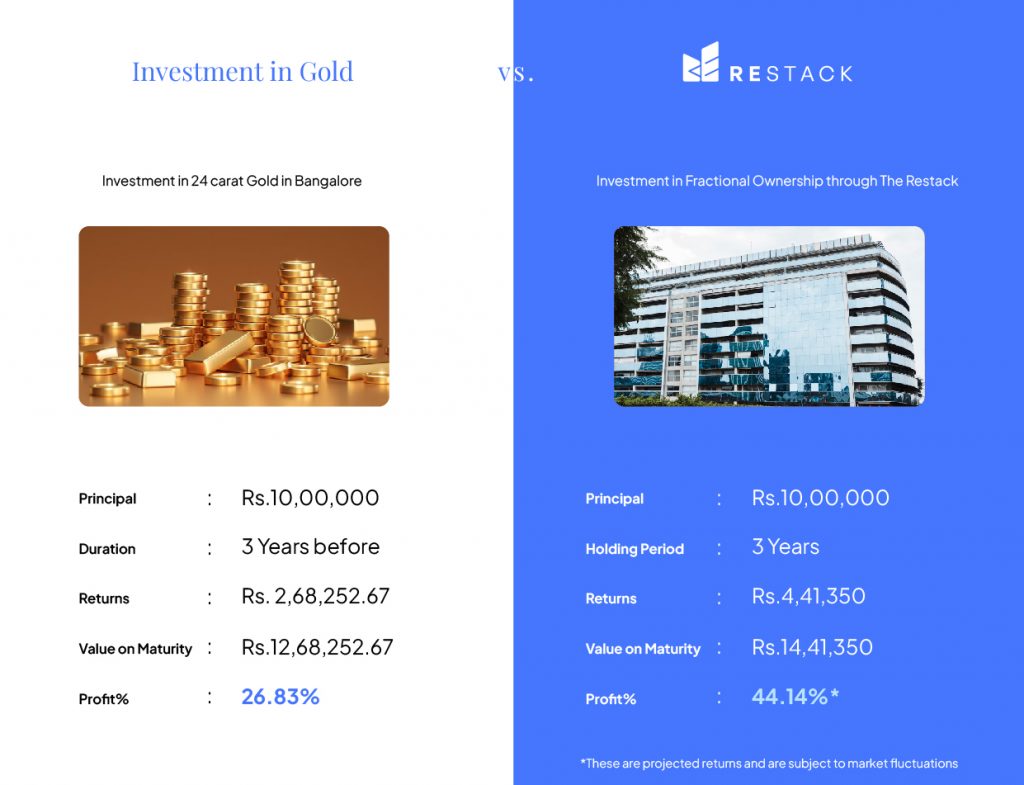

Three-Year ROI Snapshot: Gold vs. Fractional CRE Investment

Within a three-year time frame, Rs. 10 Lakh investment in gold and fractional real estate through The Restack will yield tangibly different profits. While gold provides a profit of approximately Rs. 2,68,252 (26.83%), CRE investment creates a total profit of Rs. 4,41,350 (Total return of 44%).

Choosing the Right Investment for You

It’s always advisable to diversify your investment portfolio to manage risk and reward effectively. Fractional real estate investment presents an exciting alternative to both traditional commercial real estate and gold. It offers the opportunity to enjoy the financial benefits of property ownership, with a more accessible entry point and fewer ongoing responsibilities. It’s a new, dynamic way to grow your wealth.