The Indian real estate industry is poised for robust growth in 2023. Between 2023 and 2028, the Compound & Annual Growth (CAGR) for the Indian real estate sector is expected to reach 9.2%. However, while commercial real estate (CRE) can be a highly lucrative way to generate passive income and build wealth, it can also be a difficult industry to break into. Screening and doing due diligence on properties, managing tenants, and dealing with maintenance issues are just a few of the many challenges that real estate investors face. Additionally, the high cost of buying a pre-leased commercial property outright can be a significant barrier.

For individuals who want to start small or diversify their investment portfolio, fractional real estate investing can be an attractive option. Fractional real estate investing allows investors to start small, gain experience, and mitigate some of the key risks associated with real estate, while still benefiting from the real estate market growth.

In this blog, we take you through the process of foraying into fractional real estate — key benefits, processes, and how to get started.

Key Benefits of Fractional Ownership in Real Estate

-

Access to high-value properties

Investing in a single property by yourself limits access to Grade A commercial property, which in turn limits rental income potential. Compared to this, fractional investment opens access to the same premium commercial properties with much greater income potential. Thus, fractional ownership provides access to high-yield real estate alternative assets previously only accessible to High-Income Individuals (HNIs) or institutions due to their connections and capital availability.

-

Diversification

Diversification through a new asset class helps mitigate risks and strengthen your investment portfolio.

-

Lower investment size

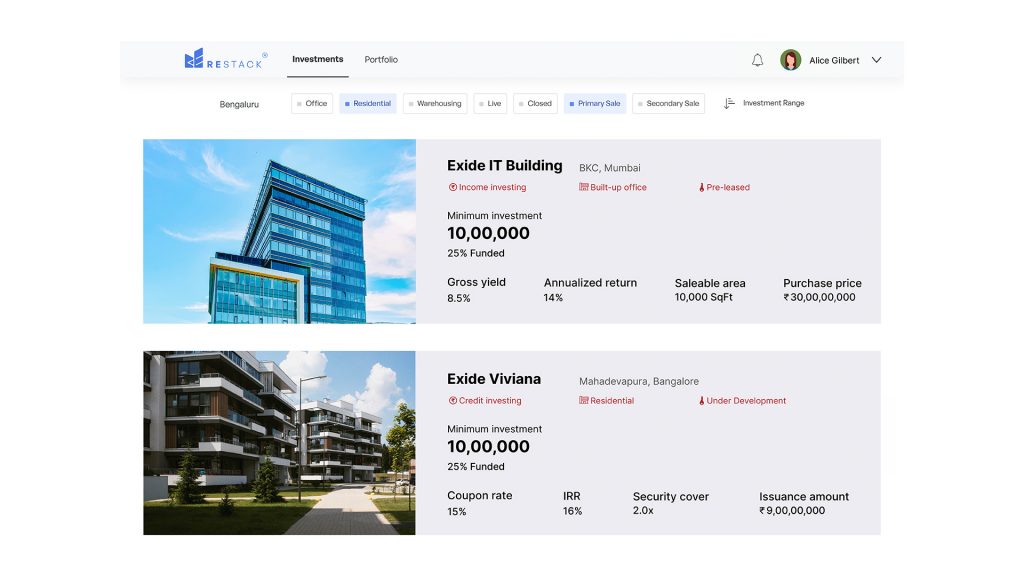

The amount required to start investing is much smaller than traditional real estate investment. Investments on The Restack platform starts at INR 10 Lakhs.

-

Passive income

Earn steady income through rent from fractional ownership or interest on debentures (NCDs). Since the responsibility of maintenance is on the platform, the investor does not have to worry about day-to-day management of the property.

-

Flexibility

The Restack ensures flexibility for investors. Unlike traditional real estate investment that requires complete ownership, fractions are easier to buy and sell. This means that investors can exit after a specific period of time, without the hassle of selling a whole property.

-

Minimal effort:

Since platform experts take care of vetting, screening, and property management, investing in fractional real estate takes very little effort for the investor.

How Does Fractional Real Estate Investment Work?

Getting Started

It’s evident that real estate investment has several advantages, and offers rewarding returns. But before investing in fractional real estate, investors should understand the key fundamentals of evaluating the property – such as location, developer, quality of the building, quality of tenants, and lease deed terms.

To navigate these complicated waters, a reputable fractional real estate investment platform is critical. While selecting a platform for investment, investors should carefully evaluate the investment opportunities offered by the platform, considering factors like location, property type, and expected returns.

The Investing Process

The basic idea of fractional real estate investing is simple: you own a fraction of a real estate property instead of the whole thing, and get all the same benefits of ownership against the portion that is yours.

Here’s how that looks for you – the Investor. A fractional platform like The Restack offers a real estate investment, often commercial, and splits the property’s cost into fractions. Each fraction represents shares in the SPV (Special Purpose Vehicle) that owns the property, and these fractions are sold to the investors. When an investor owns these fractions or shares, they also possess fractional ownership of the property through the SPV. Once you become an investor, you receive cash flow from the rent paid on the property based on your fractional ownership.

This sounds fairly simple, but what about the tedious processes involved – screening, payment, document execution, and property management? That’s where a dedicated investment platform like The Restack comes in, helping you manage the process end to end, from the comfort of your home.

This is how The Restack does it:

Step 1: Sourcing Institutional Grade Premium Properties

Our experienced on-ground team obtains hundreds of proposals from across India. Plus, we directly receive property proposals from sponsors through our relationships. From these proposals, we select high-quality real estate properties that fit our first screening checklist.

For the selected properties, our experts perform detailed evaluations and diligence on the market, asset, title, and technical aspects. This is done to ensure that the properties selected offer the highest returns and lowest risks and are located in attractive micro-markets with high-quality tenants.

The Restack facilitates the creation of a special purpose vehicle, or SPV, to work out the optimal holding and capital structure.

Step 2: Serving Investors through an All-In-One Digital Platform: From Investing to Exiting

Only approved commercial properties are posted live on our platform for investing. As an investor, you sign up on our website, through a short and simple process that takes only a few minutes. Once you’ve signed up, you have access to all the listings on The Restack – starting at as low as INR 10 lakhs. From these listings, you can pick your investment based on property type, size, and returns.

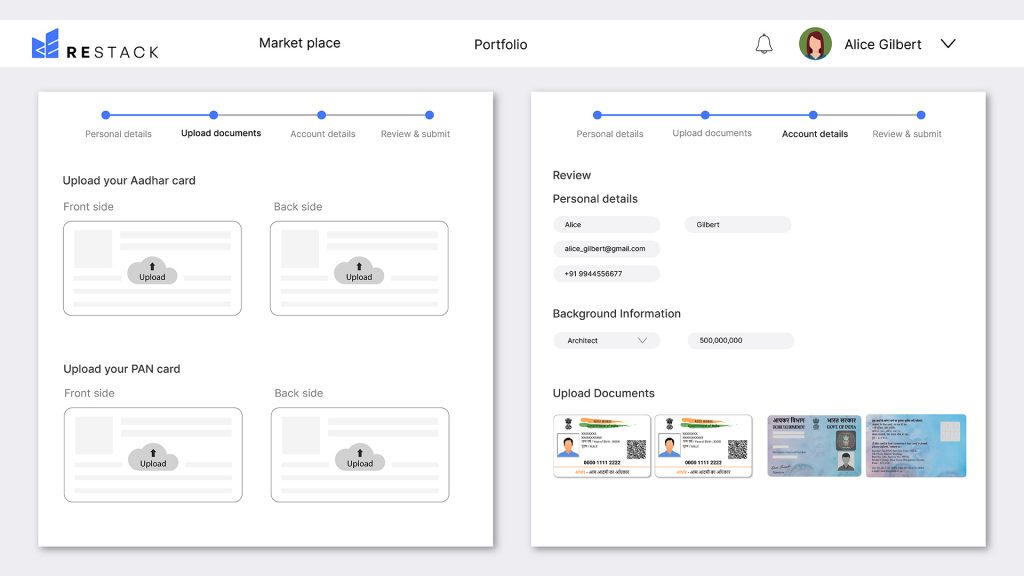

Next, you have to complete a simple KYC process and provide information on identity, address proof, and bank account details.

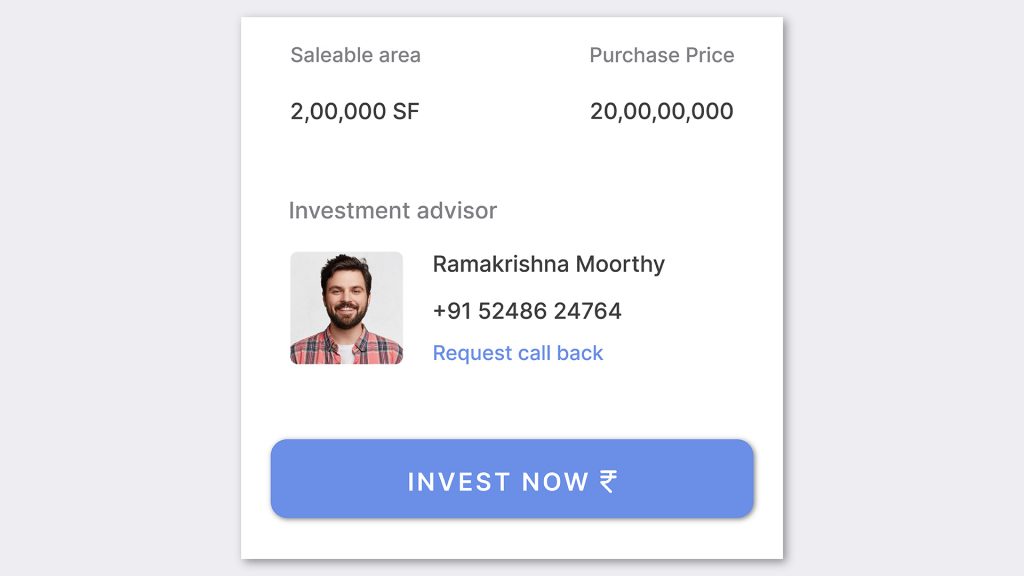

After this, you can simply click on “Invest Now” and transfer the token payment amount to a designated escrow account, where your funds are kept under the custody of an independent Trustee. You can then execute a term sheet digitally. Once you’ve signed the term sheet, your fractions towards your investment will be reserved. The listing remains online for about 30-90 days until 100% of the funding target (or property cost) has been reached. Post this, you have to pay the balance amount so that SPV acquires the property and equity shares are issued to you in proportion to your investment amount. All documents of ownership are executed digitally.

For the duration of your co-ownership, The Restack takes care of managing and maintaining the property, making sure that property taxes are being paid on time, and regulatory compliances are met. Additionally, our team ensures that timely rental payments are made to you – directly to your bank account. All the processes are handled by The Restack, and you can simply use the easy-to-navigate dashboard to monitor your property updates and income distributions.

Finally, when you want to exit the investment, you can turn to The Restack’s dedicated proprietary secondary marketplace. Resell your property with ease and cash out your capital along with your profit from capital appreciation.

The Bottomline

For years, premium real estate has remained inaccessible to retail investors due to its high-ticket prices and the challenges involved in managing large asset portfolios. The Restack provides access to such lucrative investments to the retail investor as an alternative investment avenue, while professionally managing the property through an in-house asset management team.

Considering diversifying and growing your wealth by investing in high-quality real estate? Visit our Investments Page and get started today.