A well-rounded investment portfolio is essential for managing risk and ensuring long-term financial stability. Among the available asset classes, real estate stands out for its stability and potential for both income generation and capital appreciation. In India, the sector has become even more attractive, with rapid urbanization, infrastructure growth, and government reforms driving demand and creating new investment opportunities.

Investor behavior has also shifted, moving away from long-term, generational property purchases to more strategic, flexible approaches. Modern investors are now seeking liquidity and diversification, embracing accessible real estate options that align with India’s dynamic economic growth and evolving market trends.

Understanding the Indian Real Estate Market

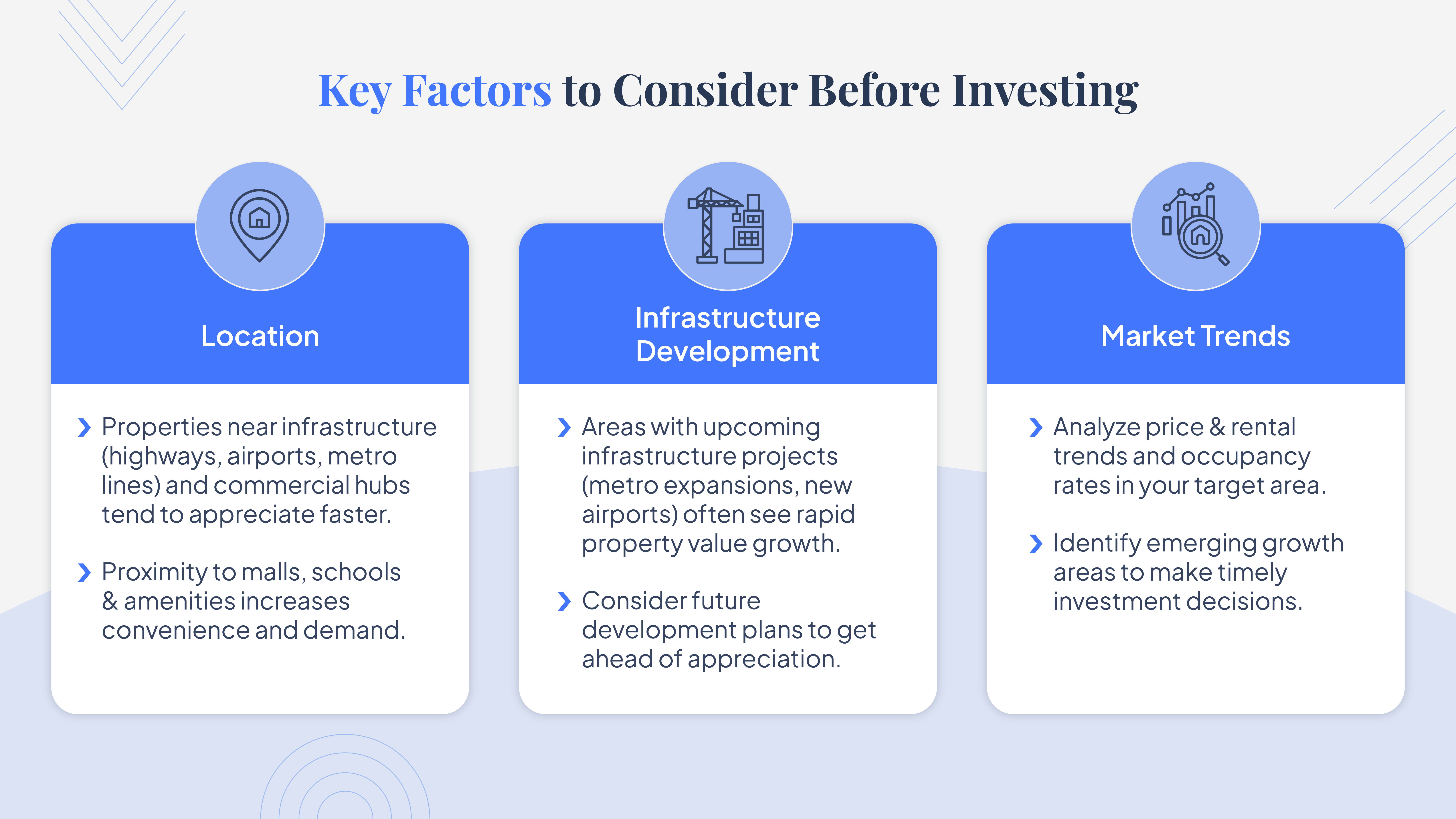

India’s real estate landscape is diverse, with its key markets spread across Tier-1 cities like Mumbai, Delhi, Bengaluru, Hyderabad, Chennai & Pune which continue to dominate in terms of demand and investment opportunities. These metropolitan areas offer high returns due to their status as economic hubs, driven by a growing population and the presence of multinational corporations. However, emerging Tier-2 cities like Ahmedabad, Kochi, Indore, Chandigarh are also drawing attention. These cities offer relatively affordable property prices with significant growth potential as businesses expand beyond major urban centers.

Government initiatives like Pradhan Mantri Awas Yojana (PMAY) have made housing more accessible, while the RERA has increased transparency and investor confidence. Meanwhile, infrastructure developments, including new airports, highways, and metro expansions, are boosting property values by improving connectivity. These projects are turning previously overlooked areas into real estate hotspots, driving demand and making real estate investments more attractive.

With a clear understanding of the market, it’s important to explore the different types of real estate investment opportunities available to investors.

Types of Real Estate Investment Opportunities

Investors can choose direct ownership in residential, commercial real estate and land, each with its own advantages. Residential properties offer steady rental income (~3% p.a.) and high appreciation, while commercial properties can generate higher rental income yields (~8% p.a.) but often come with high barriers of entry.

For those with limited capital, Fractional Ownership, Real Estate Bonds & REITs are appealing alternative investments that come without the headache of property management.

Secured Real Estate Bonds is a high yield alternative to property ownership, providing high fixed returns and predictable cashflow from real estate.

Fractional ownership allows investors to buy a fraction of a property, sharing both the costs and profits.

Real Estate Investment Trusts (REITs) further democratize real estate investments by allowing individuals to invest in a diversified portfolio of income-generating properties without owning them directly, offering higher liquidity and lower entry barriers.

Strategic Approaches to Real Estate Investment

Diversification is key in any investment strategy. Spreading your investments across different property types—residential, commercial, or even land—and locations helps reduce risk and smooth out returns.

Investors should aim to balance Income and property appreciation in their real estate portfolio. They can allocate their capital between direct ownership to benefit from high property appreciation or alternative investments to benefit from generation of regular income.

To hedge against the risks of a property downturn, it’s wise to invest a portion of your portfolio in Secured Real Estate Bonds which offer fixed returns even when rental yields & property values fluctuate.

Finally, timing the market plays a crucial role in real estate investment. Recognizing where the Indian market stands within the real estate cycle (e.g., expansion, peak, contraction) can help you make smarter purchasing decisions.

However, even the best strategies can fail if certain pitfalls aren’t avoided.

In conclusion, real estate remains a vital component of a well-balanced investment portfolio, offering both stability and growth potential. India’s real estate market is experiencing unprecedented growth, creating an incredible opportunity for investors to expand their wealth. With the sector continuing to thrive, now is the perfect time to take advantage of this upward trajectory.

Whether opting for direct ownership or exploring alternative investment options, strategic planning and market awareness are essential. By diversifying investments, carefully considering location and trends, and embracing innovative platforms like Restack, investors can optimize returns while managing risk effectively in the ever-evolving real estate landscape.

By investing with The Restack, you can seamlessly tap into the booming real estate market and position yourself for high returns from the comfort of your home. Start growing your wealth through real estate today with The Restack.