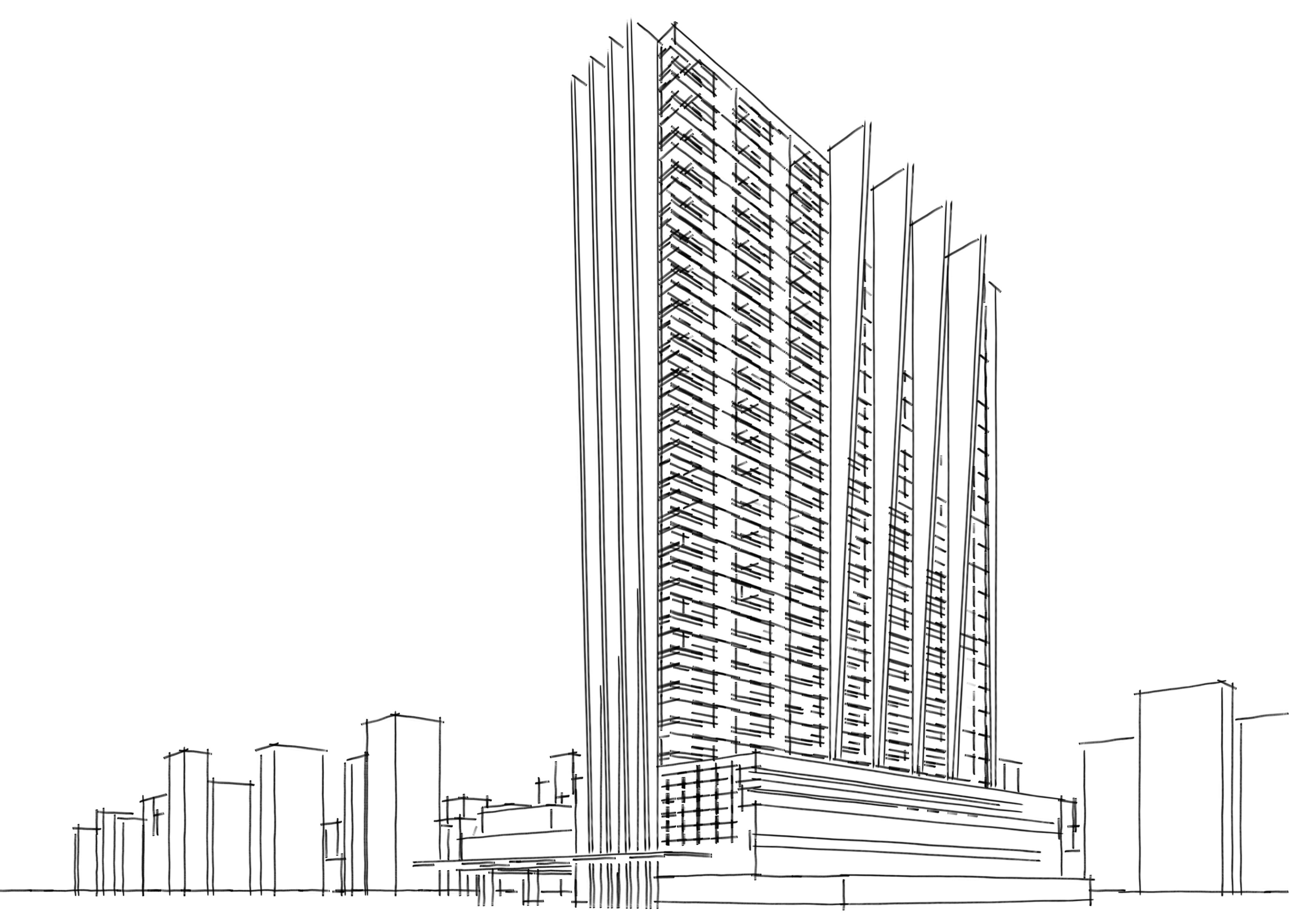

Earn High Returns with

Alternative Investments in Real Estate

High Returns of 16.1% IRR

Monthly Interest Income

Plotted Project in Bangalore

Security Cover of 2.9x

Diversify your portfolio.

Invest Online in minutes starting INR 10 Lakhs.

Welcome to Restack!

Investment starts INR 10 Lakhs

Speak to our Relationship Manager

Fractional Ownership

in Commercial Real Estate

Purchase Grade A Commercial Property pre-leased to MNC tenants.

Monthly Rental Income

Capital Appreciation

Professionally Managed Properties

Long lease & Lock-ins

Entry Yield

9%

IRR

16%

Investment Multiple

1.71x

Purchase Price

41 Cr

Minimum Investment of INR 10 Lacs.

Real Estate Debt Investments

Invest in Secured Non Convertible Debentures (NCDs) to fund prime residential and commercial projects.

High Fixed Returns

Monthly Interest

Tier 1 Developers

Secured by Property

Coupon

15%

IRR

16%

Security Cover

2.5x

Issuance Amount

25 Cr

Minimum Investment of INR 10 Lacs.

Investor Voices

As an investor, my goal was investing in avenues where I could earn regular passive income. With the investment opportunity offering a fixed monthly income of 15% p.a., I found it suitable for my investment goals. This investment has helped me invest in real estate without having to engage in time consuming activities of property maintenance & management. The Restack platform provides me a portfolio dashboard that provides quarterly Asset Management reports which help me track the progress and return on my investment. I highly recommend their services to anyone looking for a reliable and supportive investment experience.

P S Sumathi

Chief Manager, HDFC Life Insurance, BangaloreThe investments are diligenced by top tier consultants and full details on the micro market and its growth potential are provided, making it easy to tap into the growth potential of other cities. Although I'm based in Mumbai, I've been able to capitalize on the Bangalore real estate market. Service levels are very high and the investment process is seamless.

Hoshang Vajifdar

President, TISOCAM, MumbaiOne amazing fact about the platform is that it brings to retail investors the benefits of high interest earning options, which generally are restricted to institutional investors. In terms of risk management, I find that the financial review of the counter party and the security documentation related to the deal were really well handled; hence enhancing the faith of the investor in the investment. Being a digital platform, I was able to complete the KYC and investment without the need to visit any office. My best wishes to the team and hope to much more investment options in the future.

Ashish Negi

Country Transaction Banking Head – Arab BankAs a beginner investor, I was first approached by Insurance agents with pension cum insurance plans. Even though initially it looked promising, on closer inspection and after detailed calculations the option was not very lucrative. Then we started evaluating other options. Most of the entry level commercial real estate required on average 25 lakh to start and physical real estate investment also required heavy initial investment. On evaluation of existing platforms, we found The Restack met most of our objectives. Initial entry investment was well suited for newly married young couples. We found the nature of properties chosen is well suited for current market needs and returns are fixed and transparent. Overall, we are happy and satisfied with offerings from The Restack.

Yadunandan Puttaswamy

Staff Engineer- Infineon TechnologiesAs a Finance Professional, my demanding professional life often leaves me with limited time for personal financial endeavours. That's where The Restack has been an absolute game-changer. The NCDs, backed by plotted development with minimized development risk and developed by a Tier-1 developer, have provided me with a secure and lucrative investment avenue. The Restack's seamless, professional process has made real estate investment an easily manageable part of my financial portfolio. I wholeheartedly recommend it to fellow professionals seeking effortless, high-reward investments.

Bhavana Khemka

Partner – Triage Consultants LLP BengaluruI stumbled upon Restack when looking for a short-term investment backed by real estate with good returns. The website was easy to follow, and the investment advisor quickly addressed all queries, and I was good to go. The portal has an investor section where all documents regarding the underlying asset are clearly saved. The investment proposal and agreement are clear and transparent and easy to follow. In this specific investment, the partner involved is a reputed builder which gave me confidence on the ability to pay on time and reduce the risk of default although it's backed by collateral in the form of land. Their client profiling and risk management seems spot on. This has helped me diversify my portfolio and helps gain higher return with limited risk. I look forward for more investments with Restack given my good first experience.

Shilpa Suman

BangaloreMy experience with The Restack has been excellent. The team's understanding of real estate investing and the property markets intricacy made me choose them. Their professionalism and responsiveness in addressing my queries instilled a great deal of confidence in my investment decision. One of the standout features of The Restack is their digital investing. From the ease of completing KYC formalities online to the transparent handling of fund transfers, The Restack has streamlined the entire journey.

S Baaskaran Deekshadar

Founder Partner, Gruham Advisory LLPMy journey on The Restack platform was seamless and insightful, and the user experience was excellent. The Restack team's dedication to explaining complex real estate investments was remarkable. They simplified everything, making it easy for me to make my real estate investment and diversifying my investment portfolio.

Captain Kuppasamy Thiyagarajan

Country Manager – Sri Vel Commodities Pvt. Ltd. Chennai

Our Successful Placement Track Record

15 Crores

Restack & Retail Investors

Follow on

Restack & Retail Investors

25 Crores

Restack & Retail Investors

14 Crores

Restack & Retail Investors

25 Crores

Institutional Investor

25 Crores

Institutional Investor

65 Crores

Alternative Investment Fund

150 Crores

Housing Finance Company

175 Crores

Institutional Investor

23 Crores

Institutional Investor

75 Crores

Consortium of FIs

55 Crores

Institutional Investor

45 Crores

Institutional Investor

51 Crores

Institutional Investor

22 Crores

Institutional Investor

625 Crores

Global Alternative Investment Firm

Our Partners

We work with leading industry players to provide you with a secure, transparent and a robust real estate investment and asset management process.

Legal Advisors

Trustee & Monitoring Agent

Escrow Agent

Real Estate Data and Analytics

How it Works

1

Discover

Select from fractional investments offering upto 16% return.

2

Invest

Decide investment amount and invest through a fully digital process.

3

Earn & Monitor

Earn passive monthly income and track portfolio on your dashboard.

4

Exit

Resale on our secondary market for increased liquidity.

Why Real Estate

Alternative Investments?

The Restack unlocks access for retail investors to High Yield Real Estate investments that were traditionally only available to institutions & HNIs.

These investments offer high returns with regular income, unmatched by traditional investments.

Why The Restack

1

2

3

4

5

6

FAQs

What is The Restack?

The Restack is an online technology platform that provides users access to a curated set of real estate investment options and enables them to invest in any of the investments basis their selection.

What is fractional ownership or fractional investing?

Fractional ownership is when multiple investors come together to invest capital in an asset (which could be real estate, airplane, art etc.). It provides investors a percentage ownership in an asset, which gives proportionate rights in the income and capital value appreciation of the asset. It is a simple way to own an expensive asset, by splitting the ownership.

Fractional ownership of real estate splits the ownership of high value property into smaller fractions to provide alternative investment avenues to retail investors along with proportionate ownership rights in the asset.

It’s a traditional concept and the simplest example of this is owning shares in a company, through which you have a fractional ownership in the company.

What are Secured NCDs?

NCDs stands for Non-Convertible Debentures. It is a fixed-income or debt investment issued by companies to raise funds from retail investors, financial institutions and high-net-worth individuals at a fixed interest rate for a pre-agreed period (or Tenor). NCDs are non-convertible meaning that they cannot be converted into equity shares of the company and hence offer a fixed return which is paid on a monthly, quarterly, semi-annual or annual basis over the Tenor.

Secured NCDs are secured by assets owned by the company, which can be sold to recover the investment. All the NCDs listed on The Restack platform are secured by real estate assets in the form of land, plots or apartments.

You can read more about NCDs and how they work in our blog. Available in the Restack Insights on resources section of the website.

Are these investments through Fractional Ownership in Commercial Property and Non-Convertible Debentures secured?

Yes, all the investments are fully secured by underlying real estate.

1. Fractional Ownership: Such investments offer a fractional ownership in the underlying real estate. The real estate can be office, retail, warehousing, data center or residential assets. Such assets could either be operational (stabilized through a long-term lease) or under construction. Comprehensive details are available under the respective opportunity sections.

2. Debt investments: In case of NCDs investments, these are backed by mortgage of the underlying real estate asset.

None of the investment opportunities showcased on the platform are unsecured.

Are all fractional commercial real estate and debenture (NCD) investment opportunities backed by real estate assets?

Yes. All investment opportunities showcased on the platform, either fractional ownership or Debt investments have real estate as the underlying asset, through ownership or mortgage in each structure respectively.

We believe that real estate is one of the most tangible asset class offering adequate security.

How is fractional investing on the platform different than REITs?

REITs, or real estate investment trusts is a trust that owns various income producing real estate. The REIT Manager has discretion to manage these assets on behalf of the REIT unitholders or investors. As per regulations, it is required to invest majority of the capital in completed assets and distribute at least 90% of the distributable income from these assets.

The key differences between REIT and fractional investing are,

1. Fractional investing involves investing in a particular asset in a particular micro-market with a particular risk profile. On the other hand, REITs are diversified across a pool of assets across geographies.

A simple way to understand this difference is investing in a particular stock versus investing in a sector specific mutual fund. Investors have their own views on each type basis individual specific risk appetite and invest across both basis their risk profiles.

2. In fractional investing, you can choose your investments across assets or geography. In REITs, the REIT manager has discretion to manage the investments through buying or selling assets.

This makes fractional investing more customizable in terms of portfolio creation and diversification across asset classes. At present REITs in India are more asset class specific.

3. REITs, listed on stock exchanges, are more volatile in terms of the price movements. On the other hand, fractional investing is less volatile when compared to REITs.

REITs have a lower investment amount and hence are more liquid as they trade on the stock exchanges.

4. Fractional investments are more illiquid, but our platform aggregates demand to facilitate secondary transfers of fractional investments.

5. At present, REITs are more asset class specific and only office REITs are available. On the other hand, fractional investing allows investors to customize their real estate portfolio from a more diverse pool of investments across asset class like office, warehousing and other emerging asset classes.

What is the license under which the company operates?

The company (Realtystack Private Limited) is registered as a broker/agent under the Real Estate Regulatory Authority (RERA) for showcasing these opportunities on a technology platform. Our RERA registrations are:

Karnataka: PRM/KA/RERA/1251/310/AG/211203/002658; and

Maharashtra: A51800033612.

The technology platform is only a medium to showcase curated investment options only to the platform’s registered users. The company will never give any investment advice or recommendation in respect of the opportunities listed on the website or for subscription to the securities and under no circumstances should the information on this website be used or considered or deemed as an offer to sell or the invitation or solicitation of an offer to buy any product or service offered by us. The investor is required to make their own independent assessment (or through their counsels) on the attractiveness of the opportunity, vetting of the diligence reports provided and conducting their independent diligence as they deem fit.

Stay in the loop with our weekly investment tips & guides

KA: PRM/KA/RERA/1251/310/AG/211203/002658

MH: A51800033612

Clayworks, Shilpa Ananya Tech Park, Electronic City Phase I,

Bengaluru- 560100

Phone no: +91 7618799817