The Indian real estate market is experiencing a remarkable surge post Covid driven by policy reforms, positive consumer sentiment and increased demand for larger homes. This boom, highlighted by a 31% increase in housing sales in major cities and a 25% rise in new launches, has been a cause of celebration for existing investors. Yet, as the market continues to flourish, it’s vital for new investors entering the fray to understand the cyclical nature of the real estate market. By grasping market trends and making savvy investment choices, new investors can easily navigate the real estate market and make well-informed investment decisions.

But what exactly is a real estate market cycle and how does it influence your investment decisions?

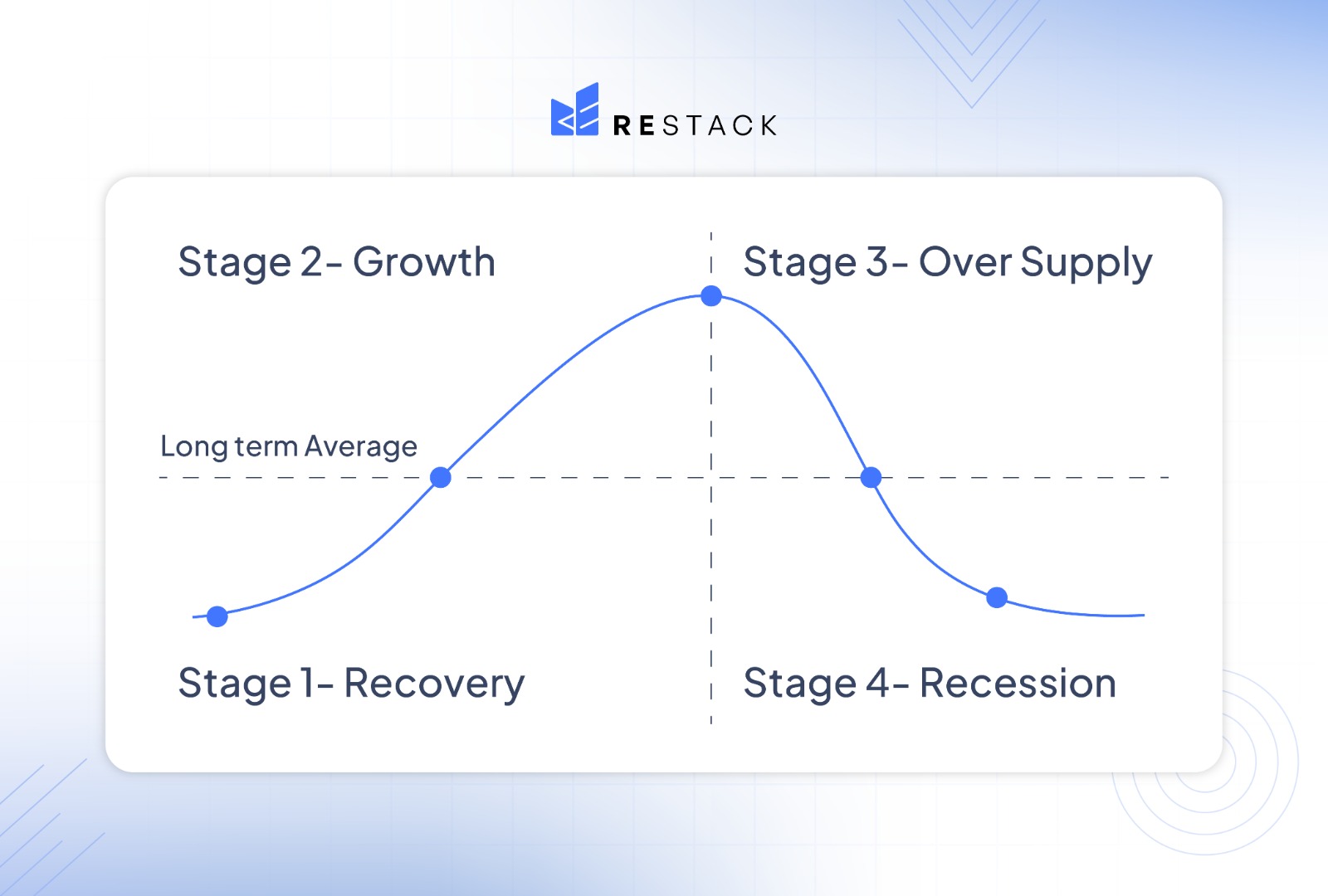

Real estate market cycles consist of the following phases, each with its own characteristics and implications for investors:

- Recovery: This phase is where the market stabilizes post-downturn, with declining vacancies but little new construction. It’s often seen as an opportune time for strategic investment. It is characterized by low interest rates & gradual increase in demand.

- Growth: Marked by rising occupancy and the launch of new projects, this phase signals a growing market where demand outpaces supply. It’s marked by rapid new construction & increasing property prices.

- Oversupply: When construction continues despite increasing vacancies and slowing demand, leading to an oversupplied market that precedes a downturn. The supply outpaces the demand leading to price stabilization.

- Recession: Characterized by high vacancy and slowdown in construction, indicating a saturated market with declining property prices, where cautious investment may be considered.

Knowing the stages in the real estate market cycle is just half the battle won. One more question needs to be answered at this point of time: At what stage does the Indian Real Estate Market find itself today?

Understanding the 2024 Indian Real Estate Market Cycle

To understand the Indian real estate market’s current phase, consider these market highlights:

- Annual residential sales hit a ten year high at 3,29,097 units in 2023.

- Massive uptick in residential prices of 10% Y-o-Y during 2023.

- Low inventory overhang ~18 months in H1 2024 suggesting that demand is outpacing supply.

- Foreign inflows in Indian real estate experienced a resurgence in 2023, marking a 20% Y-o-Y increase to reach $3.6 billon.

These indicators of decadal high sales, property price growth and increasing investment flow places the Indian real estate in its Growth phase. At this point, it is important to understand the factors that are fueling this growth and why the current upswing is likely to continue for some time.

Contributing Factors to the Growth Phase:

- Economic Growth: Robust economic and income growth in India over the last decade is driving this demand.

- Covid Driven Demand: Strong desire for home ownership including upgradation to larger homes has continued to boost sales.

- Increased Affordability: As we look back in the last decade, the residential markets have been very sluggish, with only a 3.36% p.a. growth basis Composite Housing Price index for 50 cities from 2013 to 2020. This coupled by the higher household income growth during the same period has significantly increased affordability for residential real estate. Also with interest rates at their peak, anticipated cuts will further increase affordability.

- Government Initiatives: Initiatives like Pradhan Mantri Awas Yojana (PMAY) and Real Estate (Regulation and Development) Act, 2016 (RERA) have bolstered investor confidence and streamlined market functions, encouraging both domestic and international investments.

- Increased Foreign Investment: With more liberal FDI norms, there’s a increased influx of capital in real estate which is driving construction activity of better-quality projects with enhanced specifications.

While this period is abundant with opportunities for investors aiming to leverage the sector’s expansion, it’s also important to acknowledge the challenges present. Investors must remain aware and informed about these potential hurdles as they navigate this dynamic market.

Grasping the intricacies of the real estate market is key to ensuring that your investments yield the expected returns. In the ever-changing landscape of real estate where the market cycle can significantly impact outcomes, effective diversification, robust risk management, thorough diligence and a deep understanding of market trends are crucial.

The Restack covers all these critical aspects for investors by providing expert guidance and comprehensive support. The Restack brings a wealth of expertise and insights, guiding investors through both the lucrative opportunities and the potential challenges of the market.

Start investing on The Restack platform today.