The real-estate sector has quickly bounced back from the impact off the pandemic and is on a rapid growth trajectory. Commercial real estate leasing momentum picked up after the second wave of the pandemic, when in Q3 2021 office leasing was at 83% of the 2019 quarterly average (and 2019 was the historic high for office leasing). In the residential space, sales in top 7 cities rose 71% YoY in 2021 (Source: Anarock). This is driven by a greater desire to own homes due to the pandemic impact, lowest home loan rates, increasing affordability and government sops through stamp duty reductions.

According to Knight Frank Report,2021 – “Residential prices are likely to start rising again. We project around 5% capital value growth for the residential property segment in the country in 2022.” The retail investors won’t like this opportunity to slip away from their hands and they are focusing on the new investment opportunities offered by Fractional Ownership (FO) in commercial real estate properties and Real-estate Investment Trusts (REITs).

Fractional investments and REITs are for retail investors to invest and enjoy substantial returns from Grade A commercial properties. However, it is pivotal for retail investors to understand each of these investing types and complexities involved while diversifying their investment portfolios in commercial real estate.

What are REITs?

In simple terms, Real-estate Investment Trusts (REITs) is a trust that owns and operates income producing real estate like commercial real estate.

Key Features:

Pooling of capital: It is similar to a mutual fund and enables pooling of capital from retail investors (Unit holders) and can be listed or private.

REIT Manager: A REIT manager manages the operations of the REIT on behalf of the retail investors.

Distribution: For a REIT at least 90% of the net distributable cash flows of REIT should be distributed to unit holders.

Asset Type: At-least 80% of the value of assets should be in completed and rent generating assets.

Fractional Ownership:

Fractional platforms like theRestack splits ownership of large value real estate into small ownership fractions, thereby reducing minimum investment size. TheRestack provides an alternate investment avenue to the retail investor while professionally managing the property for them through our in-house asset management teams. The property is purchased in a newly setup Special Purpose Vehicle (SPV) which is owned by the fractional owners.

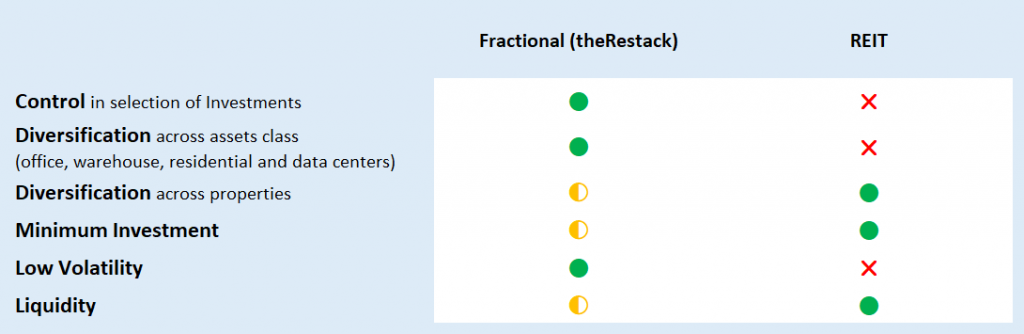

REITs and Fractional Ownership : A Comparison

Let’s evaluate the key differences between the REITs and fractional ownership in detail to assist you in making a wise investment decision.

1. Control:

Under REITs, retail investors do not have any control over the properties acquired in the REIT portfolio. This control lies with the REIT manager in terms of acquisition or disposition of the properties. However, in Fractional real estate investing, the retail investors exercise full control over the selection of the property and investment amount, and enable them to customize their real estate portfolio.

Additionally, theRestack runs an online voting process for major decisions like property sale and keeps retail investors in the driver’s seat with respect to key decisions regarding their property investment.

2.Diversification versus Concentrated exposure:

In fractional investing the investor invests in an identified property. Risk-Return of the investment is linked to a particular property in a preferred micro-market with a Grade A tenant. Such cherry picked assets can help deliver superior returns even in a slow property market. Additionally, you can diversify by multiple fractional investments across key markets and assets. On the other hand in REITs, the investment is by default diversified across a portfolio of multiple properties.

A simple way to understand this is investing in a particular stock of a company vs a mutual fund investment.

3.Diversification across office, warehouse, residential and data centers

In fractional investing, retail investors can make investments across real estate asset classes like office, warehousing, retail, residential etc. enabling absolute control to build and customize their real estate portfolio. On the other hand, the 3 listed REITs at present are focused on office assets and a few hospitality assets, thereby reducing the ability of the unit holder to diversify in other real estate assets classes.

4.Minimum Investment:

The entry cost in REIT is lower compared to Fractional investment. SEBI has now brought down the minimum application value for both REITs and InvITs within the range of Rs 10,000-15,000 compared with the earlier requirement of Rs 50,000 for REITs and Rs 1 lakh for InvITs. Fractional investment involves a higher minimum investment size between 10 to 25 lacs.

TheRestack marketplace offers access to institutional grade real estate starting 10 Lacs (Visit Market Place). The tech interface offers a fully digital investment process and ability to track your portfolio and property updates on a digital dashboard.

5.Volatility & Liquidity:

REITs can experience significant fluctuations, along with the broader stock market, during periods of economic distress, even without major changes in the fundamentals of the underlying properties. However, fractional ownership is less volatile and holds out in volatile environments displaying greater resilience in line with the property fundamentals.

REITs are listed and hence very liquid and can be easily sold or traded. The recent government regulations have reduced the size of trading lots to improve liquidity and create provisions for helping REITs raise more capital, aiding growth. On the other hand, Fractional investment is less liquid compared to REITs. However, the secondary market offerings on fractional platforms like theRestack is helping in better liquidity for exits than traditional direct real estate investing. Our platform helps generate and connects matching bids to your offer for sale of your fractional investment.

6.Stage of Development of the Property:

As per the operational rules of REIT, income-producing fully built out properties must be a minimum 80% allocation in the REITs investment portfolio. In the Fractional investment model, the acquisition of existing and under-construction properties is permitted.

7.Distributions and Returns:

REITs distribute a minimum of 90% of their distributable cash flows to the unit holders. Distributions in the existing REITs happens quarterly, whereas for CRE fractional investment, happens monthly

Returns on Listed REIT’s in India are between 10-14% including distribution and appreciation. Fractional CRE investments have a targeted IRR between 13-16%. Calculate Returns on your investment here.

Which Option is better suited for Retail investors?

‘No one-size-fits-all’. Both REIT & fractional investment have their own merits & demerits. Thus, it is fundamental for the investors to conduct due diligence and evaluate each option thoroughly before making a final decision. They both can generate desired profits however while choosing either option, investors must consider their preferences, time frame, and the risk involved.

Traditionally, it was difficult for small investors to invest in high-value properties offering higher returns because of the large investment size. Fractional ownership allows them to reap higher returns by investing in a fraction of the property along with other investors.

REITs (Real Estate Investment Trusts) on other hand are popular among those who want to invest and earn dividends from a diversified commercial real estate portfolio.

For years, Commercial Real Estate has always remained inaccessible to retail investors due to its high ticket prices and challenges involved in managing large asset portfolios. However, with the advent of online real estate investing platforms like theRestack, investors can quickly diversify and expand their wealth by investing in commercial real estate at a fraction of cost and generate a stable passive income.

Visit our Investments Page and start investing today.