Is the real estate boom in India here to stay, or is it just a temporary high?

To find out, let’s take a look back at the past decade, filled with challenges and regulatory changes. In this blog, we’ll explore what’s behind the current excitement in the real estate sector and whether it’s a lasting promise or just a passing trend. Read on to uncover the real estate market trends over the last decade.

Real Estate Cycles

Weathering the Storm (2008-2013)

The 2008 Global Financial Crisis aftermath posed significant challenges to the Indian real estate sector. A liquidity crunch, tighter lending policies and economic downturn led to a slowdown. However, from 2009 to 2013, a gradual economic recovery, fuelled by government stimulus packages and increased foreign direct investment set the stage for optimism.

The Reforms Phase (2014-2017) – Rapid implementation of Progressive Regulations

In 2014, a new government introduced the visionary goal of “Housing for All By 2022,” focusing on affordable housing and inclusive growth.

In 2016, Demonetization sucked out liquidity from the real estate markets. Further, the Real Estate (Regulation and Development) Act (RERA) brought compliance, transparency and emphasis on project delivery thereby restoring home buyer confidence. And then Insolvency and Bankruptcy code (IBC) helped create better security and enforcement mechanisms for lenders and institutional investors.

The implementation of the Goods and Services Tax (GST) in 2017 was a milestone, eliminating barriers hindering seamless transactions by unifying various indirect taxes and varied tax laws across states. This phase started the consolidation process in real estate towards Grade A and more compliant developers.

Prolonged downturn with low liquidity (2018-2021)

The NBFC crisis in 2018-19 posed financial challenges, leading to a prolonged downturn with low liquidity. At a point in 2019, almost 1,600 real estate properties (comprising 4.58 lakh housing units) were stalled across the country. An Alternative Investment Fund (AIF) of INR 25,000 Crore was set up by the government to provide capital for the completion of these undelivered homes. Further, the COVID-19 pandemic in 2020 halted all construction activities. This phase led to the gravitation of home buyer demand to Tier 1 developers and accelerated the consolidation in the sector.

Pivoting Amid Challenges (2021 and beyond)

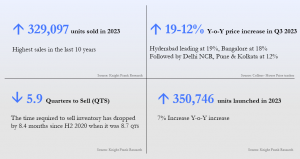

Then with Unlock post the pandemic, there was a surge in demand due to the heightened need for security and open living spaces, bolstered further by exceptionally low interest rates and affordable property prices. Fast forward to 2023, and the Indian real estate sector is on a sustained bull run. The numbers paint a vivid picture of resilience and growth:

What have these transpired into for the Real Estate Industry:

Robust Regulatory Framework with RERA and GST ensuring transparency and accountability. According to the Ministry of Housing and Urban Affairs, RERA’s implementation led to a 25% reduction in project delays and a 30% increase in consumer trust.

Consolidation of Strong Developers as a series of regulatory changes compounded by the prolonged slowdown led to the elimination of less compliant developers and increasing market share by the larger, compliant and quality players.

Greater Buyer Confidence through RERA implementation and increased transparency.

Increased Institutional Investments in Real Estate driven by the implementation of initiatives like RERA, along with robust enforcement through IBC. These initiatives have not only instilled transparency and accountability but have also created an environment conducive to heightened institutional confidence and long-term investments.

Conclusion

These fundamental shifts in the Real Estate industry, have instilled greater confidence in all stakeholders like homebuyers, lenders, regulators and developers and has positioned the sector for sustained long term growth.