India’s real estate market continues to grow post covid, with key cities witnessing significant price growth and annual India residential sales hitting a 12 year high of 350,612 units. A robust economic growth and evolving consumer preferences have led to this demand surge. Additionally, reforms in dispute resolution and government push towards completion of stalled projects have further instilled homebuyer confidence.

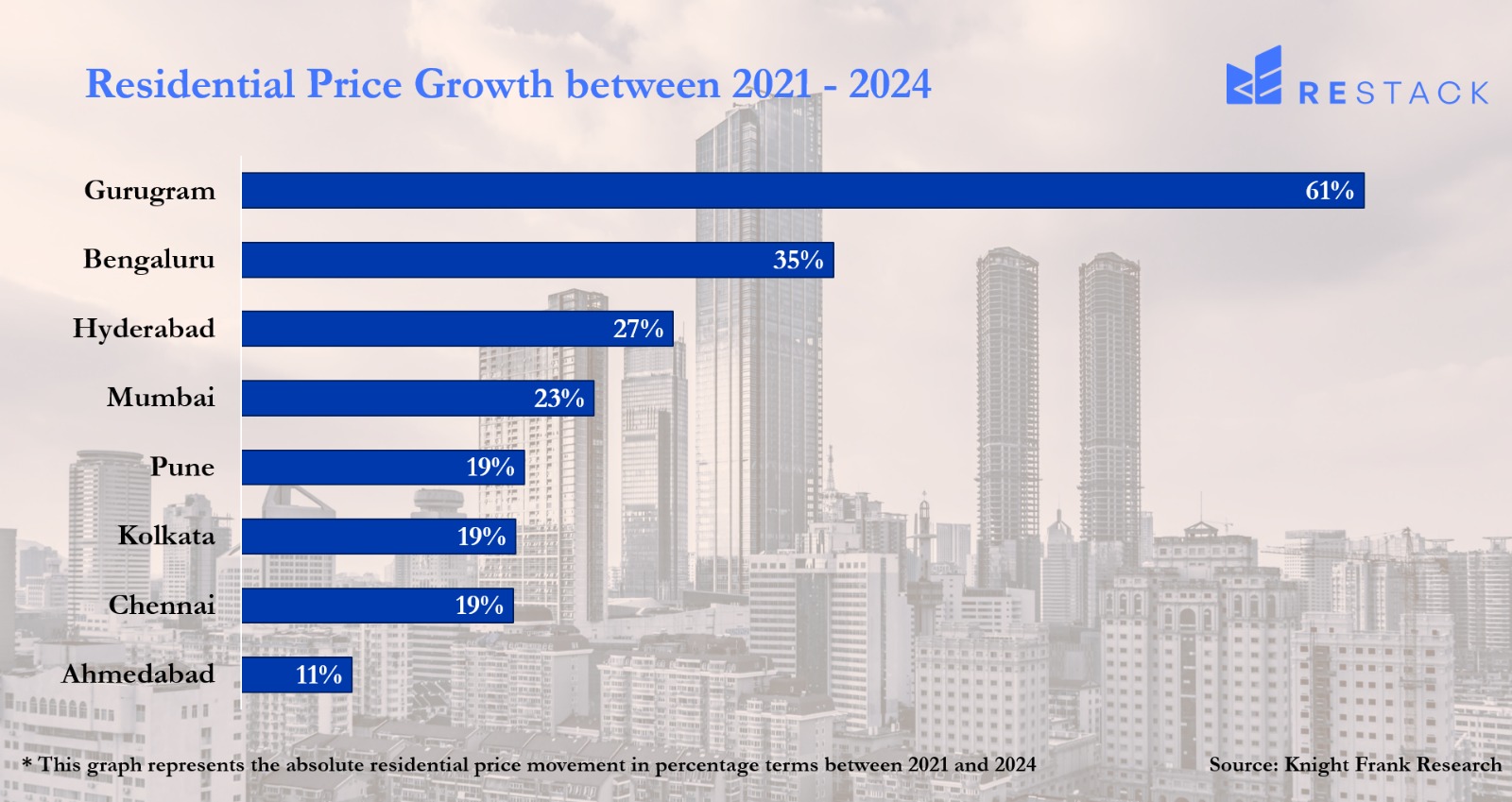

Another significant trend is the growing preference among homebuyers towards premium and larger homes, a shift which started post covid and continues, with approximately 45% of sales in 2024 priced above INR 1 Crore. While overall sentiment remains positive, understanding the top 3 cities that have demonstrated the highest price growth is crucial for investors and homebuyers looking for the best opportunities. Here’s a closer look at these top 3 cities:

1. Gurugram

Gurugram has established itself as a prime real estate destination due to it’s exceptional connectivity to Delhi, proximity to Delhi International Airport, large scale infrastructure developments and it’s status as a leading corporate and IT hub. It remains the most preferred micro market in the NCR region accounting for 49% of all sales in the region in H2 2024. The city is seeing a huge surge in luxury and premium housing from affluent buyers, which in-turn is contributing to the massive uptick in residential prices.

Gurugram has seen a 61% average price increase in the past 4 years. Key micro-markets driving this growth are Golf Course Road, Sohna Road and Dwarka Expressway.

2. Bengaluru

Bengaluru residential market has continued to demonstrate robust growth with residential sales reaching a 10 year high in 2024 with 55,362 units sold. The demand is driven by the booming IT and startup ecosystem with high earning professionals and entrepreneurs. Also, major infrastructure initiatives like new phases 2 & 3 of metro providing better connectivity options to micro markets like Electronic City, Whitefield, Outer Ring Road, Satellite Ring Road (STRR) and Peripheral Ring Road (PRR) are driving demand in these areas.

Bengaluru continues to see large influx of skilled professionals due to large corporate expansions and robust leasing activity. Bengaluru continues to be the India’s largest office market with ~25% contribution in the total India leases in 2024. South and East Bangalore dominate the sales contributing to 74% of sales volume. Key micro-markets that have seen the maximum price growth are Whitefield, Electronic city, Sarjapur road and Bannerghatta road, each recording double digit growth in the last 12 months.

3. Hyderabad

Hyderabad’s residential market continues to witness robust activity having achieved its highest ever annual sales in 2024 of 36,974 units marking a 12% Y-o-Y growth. The major factors contributing to this growth are strong economy, IT sector growth attracting high income professionals, infrastructure advancements like new metro expansions, outer ring road and regional ring road. West Hyderabad continues to be the key market for sales with 63% share due to proximity to office hubs of Hitech city and Financial district.

India’s residential real estate market has shown remarkable resilience and growth, with Gurugram, Bengaluru and Hyderabad emerging as the top-performing cities in terms of price appreciation. The trend towards larger and premium properties continues to gain momentum, with buyers increasingly seeking high-end residences driven by rising disposable incomes and evolving lifestyle preferences.

While Bengaluru’s robust IT and startup ecosystem, Gurugram’s luxury housing segment, and Hyderabad’s infrastructural advancements have propelled their markets forward, overall sentiment remains positive across major urban centres bolstered by strong economic growth. As India’s real estate sector moves into 2025, investors and homebuyers must stay attuned to emerging trends, policy changes, and infrastructure developments that will shape the next phase of growth in these dynamic markets.

Source: Knight Frank