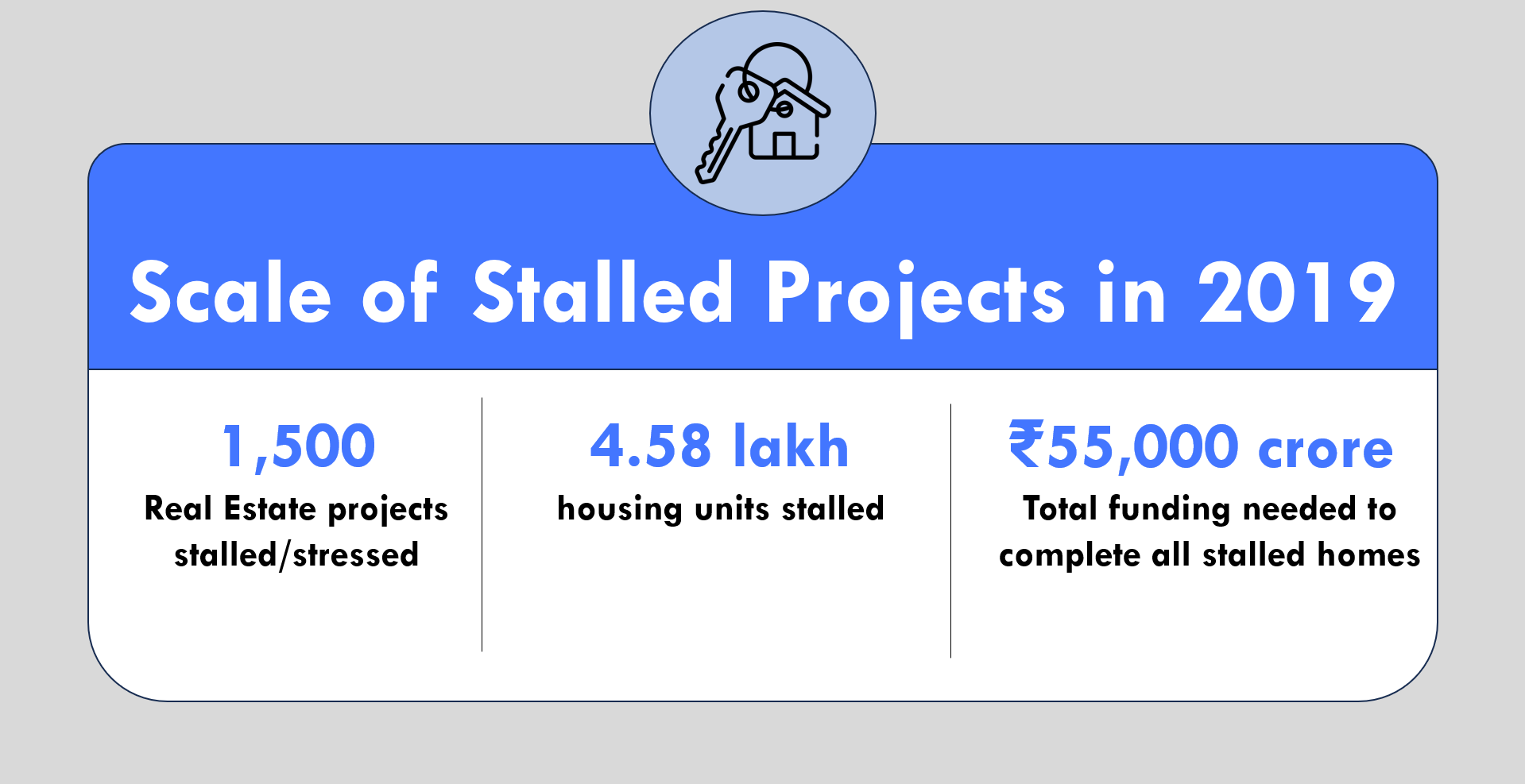

India’s real estate sector, seen as a cornerstone of economic activity, has been weighed down by a persistent crisis: stalled housing projects. From delayed towers to half-finished townships, these are projects that have halted construction indefinitely or missed significant delivery timelines. For lakhs of homebuyers, this has meant years of uncertainty, dashed dreams and locked capital for them and financiers alike.

Understanding the Causes

The root causes of project stalling are complex but traceable:

- Financial mismanagement- Pre RERA, developers often diverted funds from one project to another, aggravating delays.

- Prolonged Real estate slowdown post 2013, driven by demonetisation, reforms implementation (GST, RERA) & NBFC crisis.

- Excessive Borrowing by developers and a slowing real estate market led to financial defaults, insolvency and halted projects.

- Prolonged approval delays & sales before approvals (in the pre-RERA regime) led to major delays.

- Delayed or blocked funding for real estate due to NBFC crisis post-IL&FS default in 2018, leaving developers running out of working capital midway in projects.

These issues snowballed, leaving both developers and homebuyers in a state of limbo, especially in the affordable and mid-income segments.

Steps taken to strengthening oversight & resolution

To address these problems, India adopted a multi-pronged approach—going beyond funding solutions to include structural reforms.

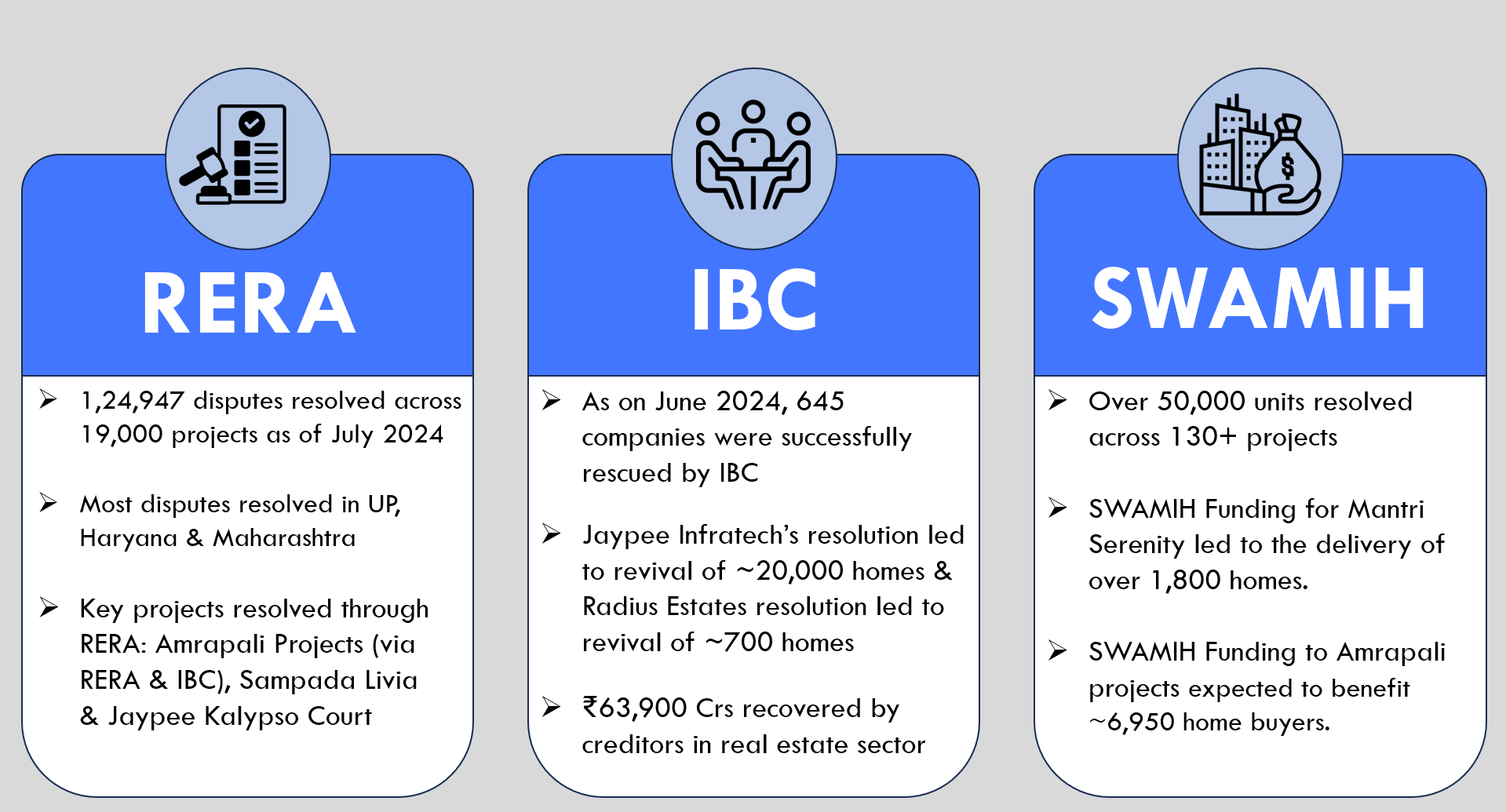

Real Estate (Regulation and Development) Act, 2016 (RERA)

RERA introduced in 2016 brought transparency, accountability and buyer protection.

- Mandatory registration of under-construction projects before sales, putting a halt to any pre-sales activity before receipt of development and RERA approvals.

- Developers to maintain project escrow accounts for construction, update progress and follow approved timelines, thereby stopping fund diversion from Projects.

- Penalizes developers for defaults and provides a streamlined grievance redressal mechanism for homebuyers.

Insolvency and Bankruptcy Code (IBC)

The IBC has become a key legal framework for many delayed project resolutions by bringing new developers or asset sales.

- Provides a unified and timebound resolution process for creditors.

- Homebuyers are also recognised as financial creditors in 2018 ensuring their representation in the Committee of Creditors (CoC).

- The process is now more project-specific, enabling resolution within larger corporate groups.

Targeted Financial Interventions

The 25,000 crore SWAMIH Fund, launched in 2019 by the government, was created to complete affordable & mid income housing by providing last mile debt funding.

- As of early 2025, it enabled the completion of over 50,000 homes, with another 40,000 under construction.

- It unlocked ₹35,000 crore in liquidity across 130+ projects in cities like Mumbai, Pune, Bengaluru, and NCR.

- To scale its impact, the 2025–26 Union Budget announced SWAMIH Fund 2.0, with ₹15,000 crore allocated to support 1 lakh additional homes.

State led interventions

In some cases, state governments (especially Uttar Pradesh, Haryana, and Maharashtra) have stepped in to complete projects via Project Management Agencies (PMAs) or development authorities.

The above mechanisms have led to multiple stalled projects resolutions across India, benefiting lakhs of home buyers and in turn restoring home buyers confidence in the sector. Refer to the chart below to see the impact across each resolution mechanism:

What More Needs to Be Done?

Despite significant progress, stalled projects remain a pressing concern. Addressing them requires faster IBC resolutions, expanded funding with government support, empowered state-level RERA authorities and streamlined single-window approvals.

Sustained, coordinated action across financial, legal and regulatory fronts is essential to restore momentum and turn stalled sites into completed homes.