Real estate development is highly capital-intensive, requiring substantial capital to launch, execute and complete projects. Hence in addition to Equity and cash receipts from project sales which are received in part payments over a period, the developer finances project development costs through various external sources of capital from financial institutions, HNIs and retail investors.

This capital can be raised at the Developer Entity level or at the Project level across the capital stack from Equity, Mezzanine or Debt structures. Each of these structures have a different risk and return profile for the investors. In this blog, we’ll delve into the primary sources of external funding and how The Restack operates in this financing landscape to curate attractive investment opportunities for retail investors.

Equity:

Equity financing involves raising capital through sale of developer’s equity shares at an Entity level or at the Project-SPV level to investors. This avenue offers investors ownership entailing potential variability in returns tied to the developer’s profits and project success without any fixed interest payouts. It is important to note that equity financing leads to ownership and control dilution, which is why developers often prefer Debt financing.

Equity structures are prevalent largely on commercial real estate (office, retail and warehouses), wherein large funds like Blackstone, GIC etc. engage in buyout of large stabilized office assets or take equity stakes in Joint Ventures (JVs) with top developers developing large IT/office parks.

Mezzanine:

Sitting between debt and equity in terms of risk and returns, Mezzanine financing is a hybrid structure. It provides profit sharing similar to Equity while offering a minimum assured return compared to Debt.

Debt:

Debt financing offers fixed returns with regular interest to investors and is secured through mortgage and hypothecation of developer’s project assets. It is the most prevalent source of finance used by developers to fund their projects or a portfolio of projects. This approach involves borrowing money from diverse sources, including banks, non-banking financial companies (NBFCs) and private debt funds or Alternate Investment Funds (AIFs). Here are some key features associated with each of the debt financing sources:

Bank Loans:

Banks provide loans to developers, typically secured by the real estate project. These funds are earmarked exclusively for project development based on the end use guidelines thereby lacking the flexibility for alternative uses. Interest rates fluctuate basis based on developer’s creditworthiness, project and security offered and market conditions. Recent trends in India indicate bank loan interest rates for real estate projects ranging from 10% to 12% per annum.

NBFC Loans:

Non-banking financial companies offer loans with less stringent eligibility criteria and more flexible terms like higher loan amounts, early-stage project funding and more flexibility of end-use. NBFCs also offer relatively quicker processing times compared to traditional banks.

However, in recent times the evolving norms have compelled NBFCs to adopt a more rigid approach, akin to traditional banks resulting in relinquishing its unique feature of flexible terms. Interest rates for NBFC loans typically start around 13% and can go higher depending on the risk profile of the project and the developer.

Private Debt Funds or Alternate Investment Funds (AIF):

These funds offer be-spoke financing solutions for developers like land funding, project acquisitions, pre-approval funding, offering top-ups or cash outs with full flexibility on end-use. However, considering the greater risk they undertake, they have higher return thresholds varying from 16% to 18% IRR.

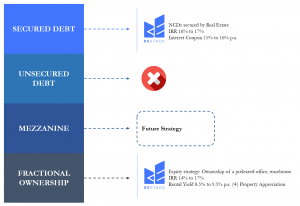

The Restack: Offering Real Estate Investments across the Capital Stack

The Restack is a Full-Stack online real estate investment platform offering curated opportunities from Fractional Ownership to High-Yield Debt Investments.

Fractional Ownership is an Equity strategy involving the buyout of a completed commercial property (which could be a preleased office or warehouse) providing investors with a percentage ownership and proportionate rights in the income and capital value appreciation of the asset.

On the other side of the capital stack are Debt Investment opportunities available on The Restack platform in the form of Real Estate NCDs (Non-Convertible Debentures) issued by prominent developers. These are secured by real estate in the form of land, apartments and plots. These NCDs extend customized financing solutions while implementing prudent risk underwriting in terms of advanced approval stage projects with greater visibility of project cash flows, micro market analysis etc. These NCDs lie delicately in the financing vacuum between NBFCs and Alternate funds.

Therefore on The Restack marketplace, an investor depending on their risk and return profile can customize and create a diversified real estate portfolio across Equity to Debt investment strategies.

Embark on your Hassle free real estate Investment Journey with The Restack.

Disclaimer:

Fractional Ownership and NCDs are subject to risks. Please make your own independent assessment of the merits and the risks of the investment opportunities available on the platform or mentioned in this blog, and conduct your own diligence and consult your own advisors on the legal, business and tax matters. The Restack does not give any investment advice or recommendation in respect of the opportunities available on the platform or mentioned in this blog and accordingly, nothing on the platform or in this blog should be considered as an investment advice or recommendation. Please refer the terms and conditions for further details.